Offshore Company in Hong Kong

International Finance Center

Simple tax system

We will only notify the newest and revelant news to you.

Whether you are doing business in Europe, Asia, Africa, the Middle East, the Americas or elsewhere, Offshore Company Corp will set up the best trading or holding structure for your business in line with local laws and regulations.

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

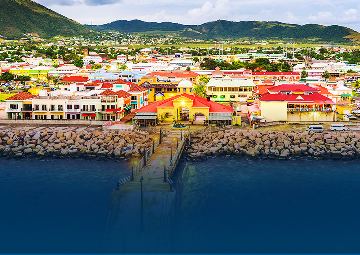

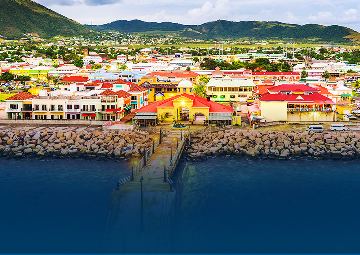

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

One of the world’s largest logistics hubs

Leading host for global foreign investment

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

Asset protection from a foreign corporation.

Better banking infrastructure.

See more jurisdiction we offer in the Asia Pacific and choose your favorite jurisdiction

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

See more jurisdiction we offer in the Europe and choose your favorite jurisdiction

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

See more jurisdiction we offer in the Caribbean and choose your favorite jurisdiction

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

See more jurisdiction we offer in the Middle East and choose your favorite jurisdiction

One of the world’s largest logistics hubs

Leading host for global foreign investment

See more jurisdiction we offer in the Africa and choose your favorite jurisdiction

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

See more jurisdiction we offer in the America and choose your favorite jurisdiction

Asset protection from a foreign corporation.

Better banking infrastructure.

From

US$ 519

The audit requirements for exempt private companies (EPCs) can vary depending on the jurisdiction and its regulations. In many countries, EPCs are subject to certain exemptions or relaxed audit requirements compared to larger or public companies. However, the specifics of these exemptions can differ significantly from one jurisdiction to another.

Here's a general overview of how audit requirements for EPCs may work in some jurisdictions:

To get specific information about the audit requirements for exempt private companies in your jurisdiction, you should consult with a local accountant, financial advisor, or legal expert who is knowledgeable about the laws and regulations that apply to businesses in your area. They can provide you with the most up-to-date and accurate information regarding audit exemptions and requirements for EPCs in your specific location. Additionally, regulatory requirements can change over time, so it's important to stay informed about any updates to the laws and regulations that affect your company.

For a public limited company in Singapore, also known as a Public Company Limited by Shares (Pte. Ltd.), the following documents are typically required during the registration and ongoing compliance processes:

It is advisable to seek professional advice from a corporate service provider or engage a qualified corporate secretary to ensure compliance with all necessary documentation requirements and ongoing regulatory obligations for a public limited company in Singapore.

The time required to incorporate a public limited company can vary significantly depending on the country in which you are registering the company and the efficiency of the relevant government authorities. Different countries have different procedures, requirements, and processing times for company registration.

In some countries, it is possible to incorporate a public limited company relatively quickly, often within a few days. For example, if you submit your application for company incorporation and business registration in Hong Kong online, it will typically be processed within 1 hour. For hard copy applications, the processing time usually extends to 4 days.

In others, it may take several weeks up to several months due to administrative processes, documentation requirements, and regulatory approvals. For instance, in most states in the USA, the processing time for this procedure typically ranges from 4 to 6 weeks, sometimes longer depending on numerous factors.

To get an accurate estimate of the time needed to incorporate a public limited company in a specific jurisdiction, you should consult the relevant government agency responsible for business registrations or seek assistance from legal and business professionals who are familiar with the local regulatory environment. Contact us at Offshore Company Corp to receive advice and company formation support from our experts now!

Public limited companies, often referred to as publicly traded companies or corporations, have several ways to raise capital and finance their operations. These companies issue shares to the public and are listed on stock exchanges, allowing individuals and institutional investors to buy and sell their shares. Here are some of the primary methods public limited companies use to raise capital and finance their operations:

The number of members in a public limited company can vary depending on the jurisdiction and the company's articles of association. In many countries, the number of public limited company minimum members usually is 2 people.

In some jurisdictions, there may also be a maximum limit on the number of members for a public limited company. However, this limit is typically relatively high and is set to accommodate many shareholders. The specific rules and regulations regarding the number of members for a public limited company can vary from one country to another, so it's essential to consult the relevant company law or regulatory authority in your jurisdiction for precise information.

Keep in mind that public limited companies are usually formed to raise capital from the public by selling shares, so they often have a large number of shareholders compared to private limited companies, which typically have a smaller number of shareholders. Please contact us at Offshore Company Corp to be consulted about the number of shareholders.

A public limited company, often abbreviated as PLC, is a type of business entity that is publicly traded on a stock exchange, and its shares can be bought and sold by the general public. Public limited companies are common in many countries and are often used for larger enterprises that want to raise capital by selling shares to a wide range of investors.

Here's an example of a well-known public limited company:

Company Name: Apple Inc.

Ticker Symbol: AAPL

Description: Apple Inc. is a multinational technology company headquartered in Cupertino, California, USA. It is one of the world's largest and most recognizable technology companies, known for its consumer electronics products, software, and services. Apple became a public limited company in 1980 when it conducted its initial public offering (IPO) and began trading its shares on the NASDAQ stock exchange. Since then, Apple has become one of the most valuable and influential companies globally, with a significant presence in the technology and consumer electronics industries.

Please note that the status of companies can change over time, and new public limited companies can be established, while existing ones may go private or undergo other changes in their ownership structure.

There are many purposes of a business plan but the most important one is to identify, describe, and analyze a business opportunity with an eye on its technological, economic, and financial feasibility.

The business plan also can be used when seeking collaboration or financial support, it also acts as a business card for introducing the company to others, including banks, investors, institutions, governmental bodies, or any other agents engaged.

Motivational speaker for CEOs Mack Story stated on LinkedIn that operational strategies are about how things should proceed. There are established guidelines for completing the mission.

This kind of planning often outlines how the business is run on a daily basis. Operational plans are frequently referred to as ongoing or single-use plans. Plans for one-time events and activities are called single usage plans (such as a single marketing campaign). Ongoing plans comprise policies for tackling issues, rules for particular laws, and procedures for a step-by-step process for achieving specific goals.

"Strategic plans are all about why things need to happen." It involves long-term, big-picture thinking. Casting a vision and establishing a mission are the initial steps at the highest level.

A high-level perspective of the entire company is a component of strategic planning. It serves as the organization's fundamental framework and will guide long-term choices. The time frame for strategic planning can range from the subsequent two years to the following ten years. A strategic plan should include a vision, purpose, and values statement.

When something unexpected occurs or a change is required, contingency plans are created. These plans are sometimes referred to as a particular kind of planning by business experts.

Planning for contingencies might be useful in situations where a change is necessary. Although managers should account for changes when engaging in any of the major planning activities, contingency planning is crucial in situations where changes cannot be anticipated. Contingency planning becomes more crucial to engage in and comprehend as the business environment becomes more complex.

Two key considerations concerning a potential business endeavor are addressed by a feasibility business plan: who, if anyone, will buy the service or product a company wishes to market, and can the venture be profitable. Feasibility business plans often have sections detailing the need for the product or service, the target market, and the necessary funding. A feasibility plan concludes with suggestions for the future.

October of 2022 has become a successful month for Offshore Company Corporation (OCC) as we have partnered with SAP - world’s leading business management software producer - to streamline operations and improve our services.

In order to thank you for the long ride we've had over the past time, One IBC would like to bring you an exclusive OCTOBER SALE - Seasonal packages for those who wish to open an offshore company in Seychelles.

There are four rank levels of ONE IBC membership. Advance through three elite ranks when you meet qualifying criteria. Enjoy elevated rewards and experiences throughout your journey. Explore the benefits for all levels. Earn and redeem credit points for our services.

Earning points

Earn Credit Points on qualifying purchasing of services. You’ll earn credit Points for every eligible U.S. dollar spent.

Using points

Spend credit points directly for your invoice. 100 credit points = 1 USD.

Referral Program

Partnership Program

We cover the market with an ever-growing network of business and professional partners that we actively support in terms of professional support, sales, and marketing.

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.