- Notifications

We will only notify the newest and revelant news to you.

The preparation of financial statements in the UK is a critical process for businesses of all sizes. These documents are not only essential for statutory compliance but also provide key insights into the financial health of a business, guiding strategic decision

In the UK, the preparation of financial statements must align with specific accounting principles and frameworks to ensure clarity, consistency, and comparability of financial information. These statements include the balance sheet, income statement, statement of changes in equity, cash flow statement, and accompanying notes. They provide stakeholders with detailed insights into a company's performance, financial position, and cash flows over a financial period.

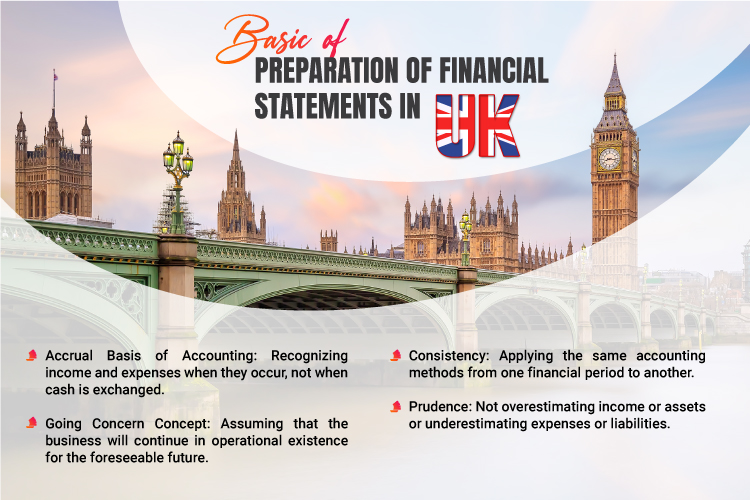

Financial statements in the UK must be prepared according to the Generally Accepted Accounting Practice (GAAP) or International Financial Reporting Standards (IFRS). These frameworks provide the foundation for financial reporting and ensure that the financial statements are accurate, reliable, and consistent across all businesses. The choice between GAAP and IFRS depends on the size of the company and whether it is publicly traded or privately held. Basis of preparation of financial statements in UK include

Financial statement preparation services in UK

As a small business, you have the option to submit simplified accounts to Companies House and may not require an audit.

8 Steps in preparation of financial statements in UK

Here are 8 steps in preparation of financial statements in UK:

The financial year usually spans 12 months. For established companies, it begins the day after your last financial year ended. For new businesses, it starts on your incorporation date.

Keep your accounting records at your registered office or another location deemed appropriate by the directors. These records should be accessible for inspection if requested by authorities.

Ensure the balance sheet includes the printed name of a director and is signed by them. You may also list certain items that were previously omitted.

Instead of a detailed version, prepare a simplified profit and loss statement for submission to Companies House.

The report should include the name of the director or the company secretary who has signed it.

After preparing your financial statements, compile them into annual accounts and send them to Companies House.

The deadline for submitting financial statements is 9 months after the accounting reference date for private companies, and 6 months for public companies.

You can file your annual accounts online using various software providers that facilitate account preparation and filing. Alternatively, you can submit a hard copy if preferred.

For many businesses, preparing financial statements can be a complex and time-consuming process. Fortunately, there are numerous financial statement preparation services available across the UK. These services range from traditional accounting firms to modern fintech companies that offer software solutions and consulting services. Working with a professional service can help ensure that your financial statements are prepared accurately and in compliance with applicable laws and standards. Therefore, benefits of using professional financial statement preparation services in UK:

The preparation of financial statements in the UK is an intricate process that requires thorough understanding and careful implementation of accounting principles. Whether handled internally or outsourced to experts, the meticulous preparation of these documents is crucial for achieving compliance, securing investor confidence, and steering strategic business decisions. As such, leveraging professional financial statement preparation services can be a wise investment for UK businesses aiming to maintain robust financial practices.

Latest news & insights from around the world brought to you by One IBC's experts

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.